Funding is one critical element that every entrepreneur needs to prepare for. It enables every startup to advance from idea stage to business planning to creation and scaling up.

Funding Your Startup

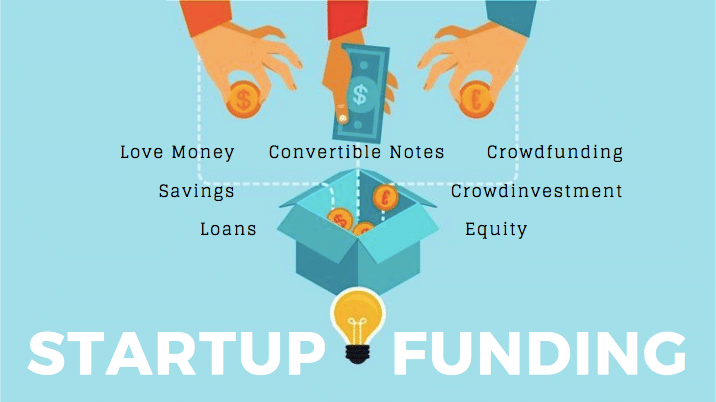

There are three general categories of funding: bootstrapping, debt and equity. Bootstrapping

includes minimizing the spendings in personal and business finances. Debt covers bank loans, trade credit and borrowing from friends/family (a.k.a. “love money”). Equity includes crowdinvesting/crowdfunding, convertible notes, and even funds from friends/family, depending on your agreement.

Preparing For Funding

Before searching for and choosing a source funding, the most important step for every entrepreneur is to create a business plan. Defining goals and milestones allows for a more accurate projection of one’s financial needs, especially the minimum budget necessary for at least the first year of building a startup. Founders, along with their co-founders, also need to assess their current financial situation. Evaluating your starting point and short and long-term needs as accurately as possible makes for a more solid financial assessment.

Some questions to consider: How much funding will you need? Will you be dedicating yourself to your new startup full-time or just part-time? If you choose to do it full-time, you may need to secure more funding upfront to cover operating costs.

Below are some sources of funding that founders can consider. Sources can be combined depending on the amount needed after a budget evaluation.

Sources of Funding

Love Money

The most accessible source of funding is “love money.” Love money is capital you extended to your business that has family or friends as a source. The agreement around the funds is oftentimes customized according to the particular type of relations between the two parties.

As friends and families already know you–your values, your personality and possibly, your work ethic–a certain level of trust is already established, making them often the likeliest source of support for your business when you’re just starting out.

Outside of your immediate circle, you can also look to former colleagues or fellow alumni as potential investors in your business.

Talk through the terms with them informally but do try to establish whether it would be considered an investment for them or just a loan. You do not need to specify the terms as a business agreement, but clarifying the terms of their involvement in and expectations of your project will help to secure a good relationship in the long-term.

Convertible Notes

Another source of funding is a Convertible Note–a form of short-term debt that later converts to equity. Why use convertible notes? Convertible notes involve a faster setup and a simpler agreement. For one, it does not need a pre-valuation of a business at the offset for investors. Additionally, it avoids or minimizes turning over control to investors. Overall, it allows a for a degree of flexibility of terms when compared to other more formal agreements.

Using convertible notes can be a challenge when one is unfamiliar with how they work. Understanding it may take some time but it could be a helpful source of funding for any business. Here is a good resource on convertible notes with scenarios on coverage and agreement terms.

Crowdfunding or Crowdinvesting

Crowdfunding and Crowdinvesting are two methods for raising funds that provide access to a bigger pool of investors. Compared to other methods, they save time and money. They also help you to avoiding incurring a debt in case of an unsuccessful launch of a business.

Crowdfunding is a method of pitching a product or service to the masses. The support that any crowdfunding campaign receives is already a means of market validation of a product/service. Some challenges in doing a Crowdfunding campaign are outlined below:

- You need an engaging story. The value of a business idea needs to be communicated effectively to the market.

- Unfamiliarity with crowdfunding or the platform itself. Businesses may need to educate their target market/potential contributors about crowdfunding.

- Consideration of payout fees for platforms to use

Here’s a quick guide to a successful crowdfunding campaign:

- Get family and friends to jumpstart funding for higher visibility

- Present a realistic business plan that shows how the contributors’ money will take the business to the next level

- Be active online throughout the campaign period in all channels (answer inquiries, do continuous promotion, track progress)

The most popular crowdfunding websites are Kickstarter and Indiegogo. For a more comprehensive guide, here’s a resource on Crowdfunding.

Crowdinvesting is an equity-based crowdfunding; it is similar to crowdfunding but is aimed instead at investors. Crowdinvesting widens a start-up’s access to potential investors, including individual investors. In addition, It doesn’t necessarily require company valuation to get the support needed.

Crowdinvesting also has its own challenges, with a need to take the following factors into account:

- Proof of concept & market traction (needed right off the bat, unlike in crowdfunding)

- Financial projections

- Terms of agreement have to be explicitly defined–not flexible to amendments thereafter

- Investor relations are of utmost importance. Founders/ business owners need to build and maintain them.

Sample crowdinvesting portals are FundedByMe and Seedrs. Here’s an additional resource that can be used as a guide to running a successful crowdinvesting campaign.

Evaluating Funding Options

Each source has its own challenges. The key is to assess which method of fundraising fits your current situation and your business goals. There are several other funding options, both traditional and non-traditional methods. Whichever method you choose for your startup however, make sure to do your research thoroughly and be prepared to answer potential investors’ questions.